As we mentioned earlier, writing off unpaid invoices comes down to your accounting method. BR0BWO40 - Departmental Notice of Write-Offs: Listing of invoices debited back to your Financial Accounting Unit (FAU) for 80% of the unpaid balance. To write off an unpaid invoice, you must show that you paid taxes on income that didn’t exist because you never received it.These invoices will NOT be assigned to our agency. BR0BWB40 - Departmental Notice of Write-Offs: Listing of invoices debited back to your FAU for 100% of the unpaid balance.Write Off Unpaid Select the Write Off Unpaid button. These invoices will be assigned to our collection agency. Find the invoice Go to the Invoices screen (Work > Invoicing) and filter the view, then select the invoice there. BR0BWM40 - Departmental Notice of Write-Offs: Listing of invoices with returned mail flags debited back to your FAU for 80% of the unpaid balance.

#Write off unpaid invoices manual#

The RDS/View Direct BAR report request form (in user manual provided at the BAR system training class) can be used to obtain access to these reports.

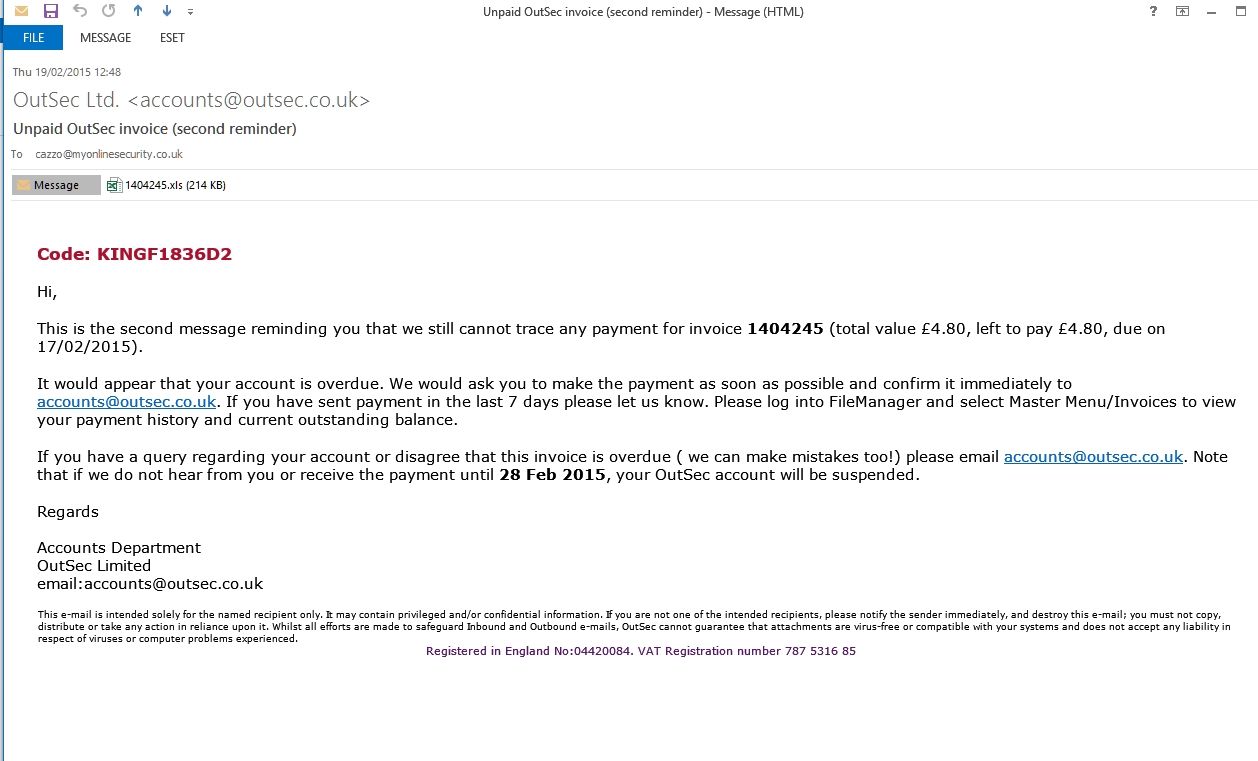

What happens next You may have to write off unpaid invoices, as it may provide your business with a tax-deductible expense. This is bad debt one that you’re unlikely to have repaid.

The BAR Bad Debt Reserve account is debited for 20% of the unpaid amount.The BAR receivable account is credited for 100% of the unpaid amount.If payment is recovered by our collection agency, the payment is credited to the BAR Bad Debt Reserve account for 80%, and the agency keeps the 20% as their fee for collecting the debt. Find the invoice Go to the Invoices screen (Work > Invoicing) and filter the view, then select the invoice there.These amounts are charged back to the departmental revenue/income account at 100%. Unpaid charges less than $25 are normally not assigned to our collection agency.When a charge is written off from the Billing and Accounts Receivable(BAR) system:.Unpaid charges on accounts with a Returned Mail flag are included in the write-off process before they reach the 180-day threshold, so the agency can initiate skip tracing activities.After 180 days for both students and non-student customers, the in-house collection effort reaches its end, and unpaid charges of $25 or more are referred to a commissioned collection agency for more stringent collection steps.You bill an invoice to insurance, only to see that they will not be covering as much as they said they would. The UC Accounting manual (see related link) requires charges to be written off before the charge can be assigned to a collection agency. Writing Off Unpaid Amounts (and Reversing Them) 2 min read. Unpaid charges are written-off (charged back to the department) when it is determined that a customer will not pay a charge.

0 kommentar(er)

0 kommentar(er)